Fixed Asset Accounting Small Business Accounting

Content

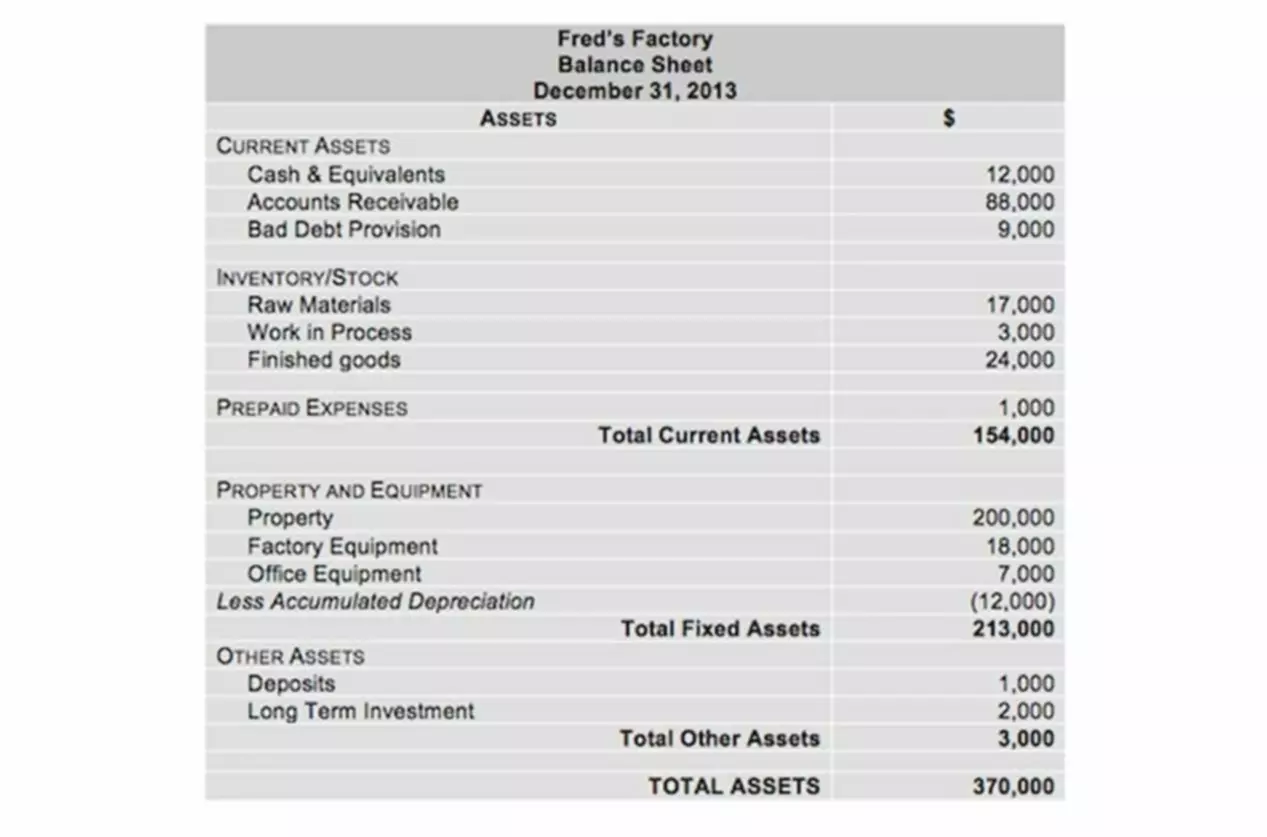

Noncurrent assets refer to assets and property owned by a business that are not easily converted to cash and include long-term investments, deferred charges, intangible assets, and fixed assets. When a company purchases a fixed asset, they record the cost as an asset on the balance sheet instead of expensing it onto the income statement. A fixed asset shows up as property, plant, and equipment (a non-current asset) on a company’s balance sheet. Fixed assets are physical or tangible items that a company owns and uses in its business operations to provide services and goods to its customers and help drive income.

ASC 606, constitutes the biggest accounting change in over a decade. Learn how NetSuite enables you to streamline revenue accounting function to ensure compliance with current and future guidelines. A fixed asset does not necessarily have to be fixed (i.e., stationary or immobile) in all senses of the word. Sign up for Shopify’s free trial to access all of the tools and services you need to start, run, and grow your business. In the meantime, start building your store with a free 3-day trial of Shopify. Try Shopify for free, and explore all the tools and services you need to start, run, and grow your business.

AccountingTools

Tax depreciation is commonly calculated differently than depreciation for financial reporting. Fixed assets are defined as essential to company operations and services in order to generate revenue, so an asset cannot be acquired with the intention of investment or to be sold on. If any asset falls into the category of PP&E but is intended to be sold, such as a car dealership purchasing vehicles, then it will need to be recorded as inventory, not as a fixed asset. Fixed-asset accounting records all financial activities related to fixed assets.

These scenarios and similar circumstances may prompt impairment testing. For example, a 30-year-old, coal-fired power plant is nearing retirement age and a new regulation appears, requiring millions of dollars in updates. A cost-benefit analysis may show that the investment in an aging plant that’s soon to be taken offline is not worthwhile. If you cannot continue to operate the plant, you would write off the remaining value of the asset, impair the asset value and write it off on your books. If the useful life of the asset or its value changes, it is classified as an impaired asset.

Fixed Assets Examples

If checks must clear and you have the cash to deposit in the bank , you may add the amounts to a clearing account. Asset disposal requires that the asset be removed from the balance sheet. Depending on the value of the asset, a company may need to record gain or loss for the reporting period during which the asset is disposed.

- Fixed assets are defined as essential to company operations and services in order to generate revenue, so an asset cannot be acquired with the intention of investment or to be sold on.

- Fixed assets can include buildings, computer equipment, software, furniture, land, machinery, and vehicles.

- It is the wear and tear and thus diminution in the historical value due to usage.

- A manufacturing company that produces car parts is a good example of a company that relies on fixed assets.

- Yet, as assets lose value as time progresses, companies also report the depreciation and amortization expenses.

- It is important for investors and analysts to understand the importance of fixed assets and how they affect a company’s financial health.

Ultimately, a company could be saddled with a higher total cost of ownership (TCO) for its fixed assets than is necessary. As a result, an inefficient fixed asset depreciation process can cause that company to waste capital that it could otherwise be applying toward smart investments that help the business grow. Fixed assets are vital for companies and organizations in realizing their objectives. These assets assist organizations in producing more products and services for their clients, hence increasing profits. Also, the information about a company’s assets bolsters the value of the company in financial analyses, since fixed assets help in providing appropriate business valuations. They may also be referred to as property, plant and equipment and recorded like that on a balance sheet.

Fixed asset

With the exception of land, fixed assets are depreciated over the length of their useful lives. Depreciation is the process of allocating the cost of the asset to operations over the estimated useful life of the asset. For financial reporting purposes, the useful life is an asset’s service life, which may differ from its physical life. An asset’s estimated useful life for financial reporting purposes may also be different than its depreciable life for tax reporting purposes. One benefit of outsourced accounting services is that small business owners can focus on doing what they do best while dedicated experts take care of the numbers. Nonetheless, at Ignite Spot, we find that our clients really excel when they understand a little bit about the services our firm provides.

While straight-line depreciation is the method most commonly used, other methods such as units of production, sum of the year’s digits, and declining balance exist. For example, a manufacturing company may use a factory building and equipment to produce computer equipment that it can sell. Fixed asset, typical of significant value, can increase a company’s overall https://www.bookstime.com/ worth and improve its ability to access capital. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Fixed Assets are resources expected to provide long-term economic benefits that are expected to be fully realized by the company across more than twelve months.

Fixed asset definition

If an asset will have a residual value at the end of its service life that can be realized through sale or trade-in, depreciation should be calculated on cost less the estimated salvage value. Remember, the depreciable life is the term that the asset is used by the owner, but if the asset is not worthless at the end of that life, estimated salvage value https://www.bookstime.com/articles/fixed-asset-accounting should be considered. The service life may be based on industry standards or specific to a business based on how long the business expects to use the asset in its operations. Certain assets may be used until they are worthless and are disposed of without remuneration, while others may still have value to the business at the end of their service life.

The DDD (Detrimental Dollar Dominance) Syndrome – CoinGeek

The DDD (Detrimental Dollar Dominance) Syndrome.

Posted: Sat, 03 Jun 2023 03:00:34 GMT [source]

Examples of fixed assets include land, machinery, vehicles, furniture, computer equipment, buildings, and other equipment. Current assets include rotating physical goods such as supplies and inventory. Fixed assets are tangible items a business owns that are held on a long-term basis, are not easily sold, and have value but are not sold regularly as part of doing business.

Acquisition: Accounting for Purchase of Fixed Assets

Fixed assets depreciation reduces tax liability, improving the internal revenue service of business operations and its ability to access salvage value. Capitalization and depreciation are proper accounting treatment that benefits a business and are reflected in financial statements and tax returns. Fixed assets are not intended for sale in the normal course of business and include items such as property, plant, and equipment. Fixed assets are long-term tangible assets that a company uses to generate income. The primary objective of a business entity is to be profitable and increase the wealth of its owners. To do so, management must exercise due care and diligence by matching the expenses for a given period with the revenues of the same period.

What are the 3 types of fixed assets?

What are the three types of fixed assets? Fixed assets are also known as PPE – property, plant, and equipment. These are the three main categories of fixed assets. They are tangible, identifiable, and expected to generate income for over a year.

Plant Accounting began taking digital pictures of capital equipment in 1997. If you would like a picture of an asset, e-mail your request to Plant Accounting. There are multiple ways to calculate depreciation, so it’s always useful to double-check with a tax professional when it comes to recording deductions. For example, if a company’s competitors have ratios of 2.25, 2.5 and 3, the company’s ratio of 3.75 is high compared with its rivals.