Best TradingView Indicators for Day Trading Forex

It’s when candlesticks are coupled with technical indicators that the bigger picture is painted. It’s important to know what bullish candlesticks, bearish candlesticks and doji candlesticks mean and look like. If the indicator line is trending up, it shows buying interest, since the stock is closing above the halfway point of the range. On the other hand, if A/D is falling, that means the price is finishing in the lower portion of its daily range, and thus volume is considered negative. A highly profitable strategy consists of many confluences with a semi-automatic system. Because you should manage your time and improve your trading psychology.

How to day trade forex markets – IG International

How to day trade forex markets.

Posted: Fri, 13 Jan 2023 10:35:45 GMT [source]

One of the most important tools for Forex traders is a set of indicators that can help them make informed decisions about when to enter and exit trades. In this article, we’ll take a closer look at the best indicators for day trading Forex and how they can be used to your advantage. Bollinger bands are a lagging indicator that can help you determine whether prices are relatively high or low, and can be useful for gaining insights on volatility. A middle line or “band” is determined, often by using the 20-day simple moving average (SMA).

Once you’ve opened an account, you can deposit funds with a debit/credit card, bank transfer, or an e-wallet like Paypal. And of course – eToro is a safe and regulated broker – not least best indicators for day trading forex because it is licensed by three reputable financial bodies. The best online brokers allow you to trade assets with leverage – meaning you can increase the value of your stake.

This can result in an overabundance of signals, some of which may contradict each other, creating confusion and indecision for traders. The MACD (Moving Average Convergence Divergence) is a popular momentum indicator for day trading Forex. It is calculated by subtracting the 26-period exponential moving average from the 12-period exponential moving average. In order to make the most of your Forex trading journey, it is essential to have the right tools and resources.

Moving Averages

A good one is the volume indicator, which can measure the market’s momentum.Differently, other pro traders use only indicators, and that’s just fine. Remember, the forex market is dynamic, and there isn’t one correct method to trade it. However, one that is useful from a trading standpoint is the three-day relative strength index, or three-day RSI for short. This indicator calculates the cumulative sum of up days and down days over the window period and calculates a value that can range from zero to 100. If all of the price action is to the upside, the indicator will approach 100; if all of the price action is to the downside, then the indicator will approach zero. One of the most popular—and useful—trend confirmation tools is known as the moving average convergence divergence (MACD).

We open a position in the trend direction following one or two candlesticks after the rebound up. False signals occur; therefore, it is advisable to open trades only when the BBW rebound was preceded by a narrow flat channel. The ADX is recommended to traders with a basic and above-the-basic level of knowledge of technical analysis.

Buy Signal

The RPO will be of interest to a beginner Forex trader who wants to get familiar with different types of multiple indicators. The primary and signal lines cross at sections https://g-markets.net/ 1-2 and 4-5, and the histogram bars are rising. If both lines are directed down, and the bars are increasing downside, below the zero line, the trend is down.

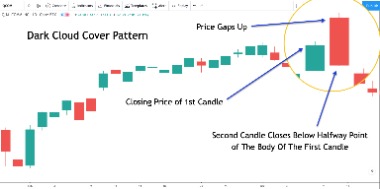

When the lines are interwoven or move horizontally close to each other, the market is trading flat. Most traders find that a better approach is to let the trade keep advancing into profit as long as it is moving in the right direction over time. This tends to be a better approach, especially when used in momentum or trend trading. One approach to manage this process is to use a trailing stop, which is typically based upon volatility or the initial stop loss, which may also be based on volatility. Another popular momentum indicator is the moving average convergence divergence (MACD) oscillator. When patterns are coupled with day trading indicators it gives traders a clear picture of an upcoming move.

Top 5 Best Indicators for Day Trading Forex

A bullish trend remains in a bullish view when the price is above the Ichimoku cloud. You can use all these indicators on eToro, our recommended forex broker. This indicator has two lines and a histogram which comes in handy. Typically, the MACD is traded when these lines cross one another, referred to as a crossover.

- Fibonacci Retracement is usually in the top 3 of each trader’s favorite technical tools.

- Day trading in the forex market requires traders to make quick decisions and react to fast-paced price movements.

- Remember that the following list of best Forex indicators is just a starting point for day traders and are not ranked in any way other than their grouping type.

- In general, a deeper pullback will result in a better price movement in the initial trend direction.

To trade the moving average a long order is opened when the indicator crosses the price upward. The moving average indicator calculates the mean of the previous close prices in a given time frame. The chart below displays the euro/yen cross with 20-day Bollinger Bands overlaying the daily price data. The chart below shows a different combination—the 10-day/30-day crossover. The advantage of this combination is that it will react more quickly to changes in price trends than the previous pair. The disadvantage is that it will also be more susceptible to whipsaws than the longer-term 50-day/200-day crossover.

On-Balance Volume

The middle line of the Bollinger band is typically a simple moving average, usually set to 20 bars. As always, this period can be adjusted to suit your trading plan. The magnitude of recent closing prices is measured and used to predict reversals; changes in trends. A simple moving average reacts slower to price compared to the exponential moving average. There are two types of moving averages which are; simple and exponential moving averages. Both of these serve the same purpose but to different degrees.

Their calculation formulas are different as different periods have different weights, depending on the candlestick number in the sequence, trading volumes, and so on. Many Forex beginners make the mistake of using too many indicators and blindly relying upon entering and exiting trades as soon as certain values are displayed. This can lead to overtrading, big losses, and a loss of confidence, because the trader who is over-reliant on indicators never learns how to read the market themselves. Stochastics are oscillators that aim to provide traders with possible buy and sell points based on changes in momentum. Prints above 80 signal overbought areas giving a selling bias, while prints below 20 signal an oversold market and a buying bias.

How to Use Trading Charts for Effective Analysis

A sell signal in the downtrend appears when both indicators are above the zero line and go down into the negative area. A buy signal in the uptrend appears when both indicators are below zero and start rising, breaking the zero line to the upside. It is suitable for any Forex trader with a certain degree of experience who can distinguish between true and false signals of oscillators. ROC is suitable for traders of any level of skills as an additional complementary tool.

- Offering an easy-to-interpret system, it enhances forex trading by leveraging the core CCI function while providing a straightforward representation of trading signals.

- With this in mind, the profit margins available when forex day trading will be somewhat modest.

- For example, if you are using it to spot overbought and oversold signals, the best way to do is to wait for an entire candle, confirming the bullish/bearish signal to close.

- Traders can also spot support and resistance levels of assets through this indicator.

Leading indicators, as their name suggests, aim to forecast price movements ahead of time. They are used to predict potential changes in the market, giving traders the chance to strategize and potentially profit from upcoming trends. The RSI (Relative Strength Index) is a popular momentum indicator that is used to identify potential overbought and oversold conditions in the market. It is calculated by comparing the average gains and losses of a currency pair over a set period of time. Traders can use EMA to find signals of trades in terms of crossovers or divergences.

Daily Fibonacci indicator

Trend oscillator TRIX is a modification of the exponential moving average smoothed several times. The rising MI line means the increase in the difference between the extreme values, suggesting the increase in volatility. If the indicator reverses in the extreme points, the trend could also reverse. At point 1, the uptrend continues after the local correction, and the signal needs confirmation. At points 2,3, and 6, the signals are clear, and the trend reverses in all three cases. At point 5, we do not consider the signal, as the market is trading flat.